Indian Contemporary Art Rebounds:

A Chat with gallerists, specialists and collectors.

The art world seems be booming, if the March auctions at Christie’s and Sotheby’s in New York are any indication. Pre-auction, a swirl of collectors, dealers, and buyers filled the chic spaces of the auction houses for cocktail soirees to view the bounty. You were bumping into hordes of collectors, art consultants, dealers and gallery owners, many of whom had traveled internationally for the auctions during Asia Week.

The sale results showed that quality trumped all else, and collectors were willing to show the money for top works by the senior modernists. An untitled painting by M.F. Husain sold for over a cool million dollars – $1,058,500 to be exact, over five times the estimated price. ‘Gestation’ by H.S. Raza, which was estimated at $600,000 and 800,000, fetched $ 1,202,500. An untitled Manjit Bawa sold for $602,500, double the pre-sale estimate.

“Prices for art around the world including modern and contemporary Indian art peaked in 2007-2008, and the Indian art market activity was dominated by art funds and speculative Asian buyers,” says New York art collector Umesh Gaur. “The speculative mania in Indian art market has corrected dramatically in the last 18 months.”

Contemporary Indian art is certainly the comeback kid if the auction results at Christies, Sotheby’s and the online auction house Saffronart are any indication. The recently concluded sales revealed a healthy appetite amongst collectors for buying the best of Indian modern and contemporary art after the slowdown experienced immediately after the economic downturn.

“Last year was a very difficult time in the market but I think this year there are definitely signs of improvement and there seems to be more energy coming out of the marketplace with people expressing more interest,” says Peter Louis, gallerist at RL Fine Arts. “People realize that it’s definitely a place where they can invest money and buy with confidence because it’s rebounded very quickly from last year.”

At this season’s auction, Sotheby’s sold 74 contemporary Indian paintings for $5.4 million, including an Untitled painting from 1955 by MF Husain which achieved the highest price of the day when it fetched $1,058,500, over five times the estimate. Sotheby’s auction included the Emanuel Schlesinger Collection of which all the works sold, totaling $ 921,650 against an estimate of $237/352,000. A Tyeb Mehta Untitled painting from 1959 from the Schlesinger Collection went for $566,000, although it was estimated for $100/120,000.

The Untitled Manjit Bawa which went for $602,500 set a world record for a painting at auction by the artist. Zara Porter Hill, International Head of Indian Art at Sotheby’s, says, “It is by far the most important work by Manjit Bawa to have appeared at auction in the past 10 years and it attracted interest from all around the world.” She notes about the high prices achieved for the art, “These results again show the appetite for good quality works with distinguished provenance offered at attractive estimates.”

It was a similar story of buzz and big sales at Christie’s: Syed Haider Raza’s Gestation, painted in 1989, brought in $1,202,500 at Christie’s. Other big names which brought in big bucks were Maqbool Fida Husain, whose Sita Hanuman, painted in 1979, sold for $842,500, Akbar Padamsee, whose Jeune femme aux cheveux noirs, la tête inclinée, painted in 1962, sold for $578,500, though estimated at $250,000-350,000. Blue Abstract by Vasudeo S. Gaitonde, painted in 1965, was estimated at $ 250,000-350,000 but sold for $554,500.

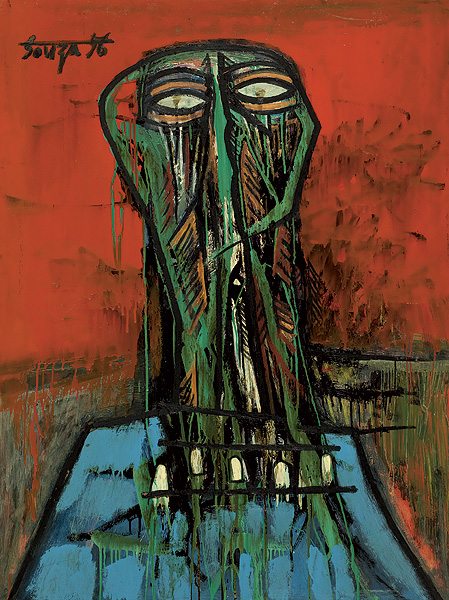

Yet another great master, the late Francis Newton Souza was in demand. His Beasts of Prey, painted in 1963, sold for $458,500. It was almost as if collectors realize that time is running out, and the time to acquire these icons of Indian art is now.

“We definitely see a pick up in the interest from a year ago,” says Yamini Mehta, Director of Contemporary and Modern Indian Art at Christies, London: “People are a lot more comfortable and willing to spend – some of the speculators are gone so now we have a solid market and a solid base, and we’ve had that for a while for the very established artists.” She points out that there is a sense that the work of many artists of the Progressives generation has been undervalued as compared to artists across other categories, so there is the feeling that now is the time to buy.

Another interesting fact was that many individual buyers were active in the sales this year, rather than museums or dealers, and even more telling was the fact that many collectors were Indian, laying claim on their heritage. At the exhibition before the sales you could also spot some Chinese and Korean collectors too, as the great value of Indian contemporary art gets more internationally known.

Sonal Singh, Associate Vice president of Modern and contemporary Art at Christies, noted that a number of new and established collectors from India and many other countries actively bid on the works. She said the high prices and enthusiasm showed “how the market had come to recognize and value really good quality works. These demonstrate the maturing of the market and the collectors’ tastes.”

Hugo Weihe, International Specialist for South Asian Modern and Contemporary art at Christie’s, says of the competitive bidding and the active participation of many individual collectors, “It was fantastic to witness so many new, as well as established clients in the room, on the phones, and on Christie’s LIVE™ making the atmosphere in the room very energetic.”

The auction world was also buzzing online with Saffronart, which is a large online fine-art auction house, selling contemporary art in its Spring Sale for $4.6 million, with 60 percent of the sold lots exceeding their high estimates. Akbar Padamsee’s 1953 portrait, Prophet which sold for $278,875, more than triple its higher estimate; M.F. Husain’s 1970s Untitled went for over $ 400,000; Subodh Gupta’s Doot, sold for $391,000, and F.N. Souza’s Decomposing Head sold for $350,750, exceeding its high estimate of $ 250,000.

Dinesh Vazirani, CEO of Saffronart, credits the strong sales to the renewed confidence of the growing collector base for Indian art: “The results from the auction indicate a consistent demand from collectors for top quality and rare works with important provenance.”

As Anu Nanavati Chaddha, director of Saffronart in New York, pointed out, the moderns did extremely well with $ 1 million mark being crossed three times whereas last year there had been just one lot that had crossed this mark. It seems collectors are willing to chase pieces with impeccable provenance and excellent aesthetic quality, like the 1953 Prophet by Padamse.

Asked if the buyers were different this year, and if India is the place where the money for the art is currently, she points out that the makeup is not that different this year but the focus is definitely on the buyers from India where the moderns are concerned. While European and Western collectors for the past several years have concentrated on contemporary art, Indian collectors have always been focused on the moderns.

As Umesh Gaur notes, this rally in Indian art is being led by the senior artists such as M. F. Husain, Syed Haider Raza, Manjit Bawa, Akbar Padamsee and F. N. Souza: “One can compare this Indian art surge to a new bull phase in financial stock markets. Significant advances in financial markets are invariably led by blue chip stocks. So it is to be expected that an initial advance in the Indian art market would be led by well established modern Indian artists.”

Peter Louis agrees that collectors are paying higher prices for the senior modernists because they feel more secure with these acquisitions: “Let’s be honest, the pool of really good works of the senior modernists from the particular golden periods is getting smaller and smaller so there is a little bit more of a race on to get those works. Are they out in the market or are people holding on to them?”

There’s always interest in contemporary Indian art, though at a different price range from the modernists and the crossover factor also comes in. “We have seen international non-Indian collectors buying modern and contemporary Indian art,” says Yamini Mehta. “A lot of younger artists like Subodh Gupta and Atul Dodiya have large followings because they’ve been seen at art fairs, biennales, and museum shows. It’s a very good time to buy because you don’t have the frenzy or hype that you might have had two or three yeas ago.”

Sanjay Reddy, a New York collector, who is also an economist explained his thinking this way: “One of the reasons we think it’s a good idea to buy Indian modern and contemporary art is because it’s an excellent hedge against the depreciation of the US dollar – it’s one of the few assets that is really international and not dependent on the fortunes of any particular country. Indian and Chinese art is one of the things that will do that because these are portable objects and in demand everywhere in the world – London, India, China, Dubai – unlike property in New York or the US shares which are focused on the US market.”

© Lavina Melwani

(This article first appeared in Hi Blitz magazine)

1 Comment

Awesome pieces of work by Souza and M.F Husain.