McMansions, hefty bank balances, unfettered success, Ivy League schools, a world embroidered with dollar signs.

For many Indian immigrants, that was the fabric of the American Dream. Add to that a Lexus and maybe a BMW in the double car garage, lots of travel, lots of dining out, and the ability to live a rich lifestyle.

For other Indian immigrants, the American Dream was much more modest—just the ability to survive, to consolidate some savings and send funds back home to family members still in the village.

Yet all these dreams, big and small, modest and immodest, have been gathered, whipped up and churned in the ruthless and noisy cement mixer of the economy—pummeled, pushed and battered by the worst crisis in memory as the global economy has taken a severe beating.

The past months have been a nightmare scenario, a meltdown of the American Dream where banks have failed, stocks have crashed, blue chip companies like Lehman Brothers, AIG and General Motors have tumbled, and jobs have disappeared. Each new day has brought new horror stories as friends and friends of friends get sucked into the economic meltdown. It was not just faraway incidents happening to faraway people, it was upfront and very personal, affecting real people, real lives. It is almost as if people rewrite the script of their lives. The American Dream, for now, has been severally downsized.

“You are asking me about my American Dream?” asks Vimal Kumar Kolappa incredulously. “What dream? We are being hit by an economic tsunami here and you are talking of the American Dream! When you are almost drowning, you are struggling to survive, to get air, you don’t think about dreams. Right now it’s so bad that if you survive, that itself is fulfillment of a dream.”

Kolappa, one of the first South Indians to get into the hotel business, lives in Little Washington, North Carolina, a town of just 5000 people. He owns 15 Hilton, Holiday Inn and Choice franchises and has another four in the pipeline. He says the hotel-motel industry which is largely owned by Indian Americans has been particularly hard-hit. Occupancies are down by 20 percent, as government agencies and businesses face a budget crunch. Only the hotels and motels in towns with military bases are doing well as families come in to meet their loved ones leaving for Afghanistan.

Business travel is at a standstill and many companies are using video conferencing to cut travel costs. With the high cost of gas, leisure travelers are also staying off the road. In fact, Kolappa recalls hearing on television about cash-strapped families putting up tents in their backyards and telling their children they were having a ‘backyard vacation.’ When that happens, hotels are nowhere in the picture.

How has it affected his life personally? “As income goes down, you’re constantly worried about how to get business in there. We’ve had to work prudently and more cost-effectively, consolidating some departments. They say the economy is getting better but for it to get better to the point where we have relief, it will take a while. The other issue is financing—I don’t know where the stimulus money went, but none of the banks are lending money for commercial projects.”

Talk to Fred Schwartz, the president of AAHOA (the Asian American Hotel Owners Association) and you understand that this is not the hard luck story of just one man but a real trend in the hospitality industry which is so heavily populated by entrepreneurs of Indian origin. “The hotel industry has been hammered by this ‘great recession,’” says Schwartz. “Sinking occupancy, average rate and hotel value has made this downturn the worst operating environment since 1932.”

According to PKF hospitality research, the forecast for 2009 is a nationwide occupancy of 54.9% and an average rate of $95.61 compared to an occupancy of 60.4% and an average rate of $106.76 in 2008. Indeed, the shrinking of hotel demand is made worse by the increase in new construction at a rate of about 3% for 2009.

“AAHOA members are working through the economic realities of today’s environment,” says Schwartz, pointing out that these hoteliers have been pioneers in the industry. “It’s an incredibly painful time for many hotel owners as they keep their service levels up, contain costs, and struggle to meet their debt service. There is not much liquidity in the lending market now. Even with ‘bid’ and ‘ask’ prices in sync, it’s tough to get loans.”

Kolappa notes that most are playing the waiting game. As one motel owner told him, “If we can meet the mortgage payments, we are winners. If we are breaking even, we are successful. At least the asset is there and one day it will bring in money.”

Nitin Shah of Atlanta has seen both aspects of the crisis in his dual roles as hotelier and banker. A founder of AAHOA, his company owns 16 hotels and he is also the Chairman of the Embassy National Bank in Atlanta. “In the 30-40 years since migrating here, this might be the worst time the community is facing, at least from the perspective of the business owner,” he says. “This recession is about the credit crisis. Businesses are down 25 to 30 percent and loans are not available.”

The homeowners’ woes are now spilling into the commercial sector, too, as many hotels were built at high cost last year and are now worth less than the loan amounts owed on them, their equity completely wiped out. What makes it even worse, says Shah, is that many of the banks which were financing them have gone under.

In fact Georgia has the highest number of bank closings in the nation: over 26 banks have closed and another 60 are on the verge of collapse, their capital exhausted by bad loans. The Haven Trust Bank, a bank started by other Gujarati pioneers of the hotel industry had enjoyed rapid success and a high profile in the community for several years before it came to a screeching halt when it was shut down by federal regulators late last year. A similar fate was met in October by the American United Bank, started just a couple years back by enterprising Indian Americans.

These setbacks seem to have derailed a budding trend of Indian Americans making blazing forays in the community banking industry as they had previously in the hotel industry.

“We are still surviving in banking because we were very conservative to begin with and didn’t grow too quickly, and so are still giving small business loans to the community,” says Shah. “I think the economy will get much worse before it becomes better. Wall Street is doing O.K. It’s Main Street without the jobs which is troubled.”

Talk to Anil Khatod, the president of TiE Atlanta, and you see the money for new ventures is indeed harder to get. He points out that venture capital funding for 2009 in the United States is likely to end below $20 billion, down nearly 36% from last year when it exceeded $31 billion. In fact, the VC funding this year represents the lowest level since 1998, and the average deal size has also dropped by more than 25%. He says, “No specific data is available on investment activity specifically in Indian-American founded companies, but these are now mainstream start-ups and likely have been similarly affected.”

He adds, “It probably has been one of the toughest periods to raise money for entrepreneurs. While there is always money available for successful serial entrepreneurs and very high quality start-ups, the bar for these has gone up considerably.”

Yet especially in these hard times, the liquidity crisis has presented a terrific opportunity for the funds with ready cash, for they can buy assets and invest in high potential companies at fairly attractive valuations. Khatod, who is with Argonaut Private Equity, says the company has invested nearly $2.5 billion in more than 30 companies since October 2008.

While entrepreneurship has always been equated with risk, a good education had always been cherished as the ticket to a comfortable job in blue chip companies with bonuses, benefits and all the good stuff. For Indian Americans in the professions, it is now an unnerving time as pink slips are handed out and companies consolidate and cut jobs.

The fabulous six figure salaries and bonuses of Wall Street are a thing of the past for most people, though some companies are actually doing well in the downturn. Sanjay Sanghoee lost his job in a big financial company in the initial weeks of the downturn and has never got back into that high flying world. For a long time he didn’t even tell his parents that his blue chip job was gone, for in the Indian culture so much self-worth is equated to your job and position.

Sanghoee, who has Merger, a published novel, to his credit, used the time to work on a future novel. He now is a management consultant and actually finds that this freedom suits him better. He says that big firms are cutting back and trying to save on health insurance and benefits and this may be the pattern for the future.

Som Chivukula is another Wall Street warrior who has been battered by the economy—but not yet beaten by it. His career path shows that no matter how carefully you think out your options, there is always a wild card to consider, an unknown which can change the game.

Initially a journalist with the ethnic media, he had joined MSNBC and later HBO’s ‘Real Sports’ as an associate producer. In 2005 he decided to embrace Wall Street by acquiring an MBA in finance and accounting from Fordham Business School. He landed his first job at Calyon, the French bank, as an associate in portfolio and balance sheet management.

“A few months later, we were noticing a slowing of deal flow. At the time, it wasn’t quite clear what would happen, though there were red flags that seemed to be cropping around us,” he recalls. “I decided to leave Calyon to find other opportunities but it turned out to be the wrong move since the recession started to pick up and I was left in the middle of the storm without a cover. I was looking for work for the next six months.”

Early this year Chivukula managed to find another job in Bintel Group, a small technology solutions company based in Princeton and even purchased a car for the commute from home to work, finally changing apartments to be closer to work. Then came the shocker—he was laid off within two months of starting work as the company was going through a rough patch. Back to Square One.

A big recession, like the one we are going through, tends to make people edgy and always thinking out of the box for solutions. To face the challenging times, he decided to hedge his bets by taking real estate classes to get his New Jersey state license, and also acquired a bartending certification from the Mixology Wine Institute. People always need a roof over the heads and something to drink, right? Says Chivukula, “The idea was to create multiple income streams—and that I beat the recession instead of vice-versa!”

Chivukula, who is an avid sports fan and has experience in organizing events and conferences, also started his own event planning company called Whole Nine Yards Events, and has acquired some clients.

Asked what the recession has taught him, he says it has definitely brought him closer to his parents and sibling as he went through all these ups and downs. It also showed him that he was strong enough to face the turmoil.

When money is tight, the first thing to get cut is the luxuries. Indian Americans are big spenders when it comes to celebrating the weddings of their children, but even this time honored extravagance is being tightened.

Rita Patel, owner of Ribha Events, a well-known wedding planning company in Atlanta, is seeing the changes in her daily business where weddings are either being downsized or postponed. “The economy has affected the South Asian market, but not to the extent that it has other markets,” she says. “I have seen a decrease in spending by 25% and postponement of weddings by 20%. From what I am seeing, most of the effects of the financial situation are going to be felt in the coming year as most potential couples have had a tough time or are just not willing to spend so much on their wedding.”

Patel anticipates some decrease in business in 2010, but believes that it will get better towards the end of the year as couples and families start getting confidence in the economy. She says, “Staying positive and being thankful for our families and health are what get me through any situation.”

In a rough ride like this economy has been, many Indians and Indian Americans have turned homewards, some because they’ve lost jobs, others for opportunities in a place which has not been as badly affected by the global recession as America has. Vivek Wadhwa, a lead researcher on the study ‘America’s Loss is the World’s Gain,’ found that many Indians who studied in the United States were returning home.

The economic downturn seems to have accelerated the exodus. “My initial prediction was that 50,000 would go back in the next five years,” says Wadhwa. “Now I’m saying at least 100,000 will go back because you’ll have tens of thousands who will have to go back as they lose jobs and visas, so this will hasten the rate of return to India and China.”

Manju Kalidindi, an immigration lawyer in Plantation, Florida, points out that there is an annual limit of 65,000 H-1B visas per fiscal year, and this has usually been met, sometimes on the very first day the numbers become available. In fact, so great was the demand that there was even a random lottery in past years.

“However, this year there are still approximately 8000 or more H-1B visas still available,” she says. “This is a direct reflection of the downturn in the U.S. economy. As employees are being laid off and employers uncertain about the future, there simply seems to be no demand for H-1s to fill jobs that may no longer be available.”

One of her H-1B clients got laid off from his job and, unable to get any other employment, he is thinking of joining his brother in business in India. This is a scenario which is being echoed in many lives. Says Kalidindi, “The Indian demand for professionals has considerably increased in the last year or so, compared to the U.S., and individuals seem to be finding better employment prospects in India. This seems to be another contributing factor as to why the H-1 quota has not yet been met.”

Interestingly enough, according to Wadhwa’s study, 30 percent of the returnees are green card holders and American citizens who are going back to escape the economic downturn and start new companies in India at a lower cost and enjoy a better standard of living with their savings. Many Indian Americans who are in academia are also finding India attractive, as hiring freezes and cost cutting hit top American universities.

A group that has taken a particularly nasty brunt of the recession are the seniors. As savings dwindle and foreclosures loom, there is the daunting prospect of depending on grown children or working past retirement age. A Pew Research survey shows that nearly four in ten workers over age 62 say they have delayed their retirement because of the recession. Look at real lives and you see the quiet tragedies taking place off-camera as many Indian seniors battle with pride and financial hardship.

Surender Rametra, an established New York businessman, is certainly not on the poverty line but at age 70 he’s seen the havoc the recession is wreaking on senior citizens. “Two years ago I felt I had a good stock portfolio, had made investments in the US and India and all of a sudden, one year ago it all looked as if it were hollow—80 percent of the savings had been wiped out,” he says.

Rametra, who graduated from New York University with an MBA in 1970 and has run successful IT businesses, adds: “I feel we are not going through a recession but a depression like the one in 1929. It has affected almost every economic group in the country. I’m now 70 and with savings dwindling to a third or a quarter of what they were before, it can make you nervous. If a person who is affluent like me can think this way, what about the person who has no job, no income and may be sick?”

Indeed, in this economy nobody is immune, and everyone is hurting, from scientists laid off by Glaxo to taxi drivers feeling the pinch of fewer rides and smaller tips. Bhairavi Desai, Director of the Taxi Workers Alliance in New York, says that cabbies, already struggling with the high cost of gas, maintenance and lease, are also faced with reduced ridership as people lose their jobs or try to economize on their transport costs. Many taxi drivers have lost their shifts as garages lease cars to the highest bidders, and drivers also face competition from illegal operators.

“All these factors are resulting in a reduction in income of 30 percent for taxi drivers,” says Desai. “I know people who are using credit cards to pay their rent or who have sent their families back because they can’t afford the costs right now.”

Perhaps the biggest impact has been on the housing market, and many South Asians are caught in the wrenching position of losing their homes and their independence. In the first shock wave of the recession many South Asians lost their homes to foreclosure while some took boarders into their homes to generate some income.

Seema Agnani, Director of Chhaya CDC, a housing non-profit group for South Asians in New York, has dealt with some of these traumatic cases. She says that the Obama Administration’s Making Home Affordable Program does not cover the more ‘exotic’ no income verification loans which many small business owners had bought their homes with.

Agnani says, “Too many people are falling for loan modification scams. These outfits are taking advantage of people who are under stress and just want an easy solution. Owners should be very careful to read all the very small print—ideally not to go to any private agencies but instead go through a certified HUD counseling agency.”

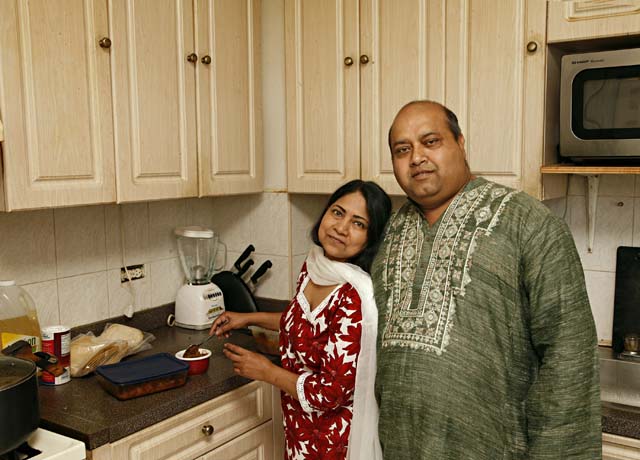

One of the stories with a happy ending is that of Rashidul and Gulshan Amin, immigrants from Bangladesh. A taxi driver, Rashidul had bought a home in 2006 but could not keep up with the mortgage payments as he was hospitalized and lost work days. He also had to pay for his son’s college tuition as the financial aid application was denied because the family owned a home. As expenses went up along with an increase in property taxes and utilities, he had another blow: the boarder in their home disappeared without paying two months’ rent.

The Amins turned to Chhaya, which assisted them in qualifying for a forbearance agreement from Citimortgage, and the counselor applied for modification to the home equity line of credit and recommended debt management counseling. Through negotiations, the couple was able to get a permanent modification to their loan, which is now 31 % of their gross income, and probably a much more realistic figure for them to be able to pay.

In this new economic climate, random happenings such as a minor medical emergency or the breakdown of the family car can become sizable hurdles rather than mere inconveniences. Individuals are tightening their belts almost unconsciously, eating out less, traveling less, simplifying their lives.

As jobs disappear and layoffs happen, people are reinventing their work life and readjusting their expectations about the American Dream. To have health and family and some form of a livelihood seem to be what most people are striving for at this time. They are learning to count their blessings and value their families and friends as a source of inner strength in tough times.

And in the end, personal attitude is what matters most. In this rough and tough economy the people who survive will be the ones who are persistent, who have the will to stick it out, to try new options, to do things differently. Many are adopting a wait and see attitude, for it’s impossible for a pessimist to survive an economy of this nature.

“To be pessimistic is like putting an anvil around your neck and trying to climb a mountain,” says Vimal Kumar Kolappa the hotelier. An optimist will always look for the bright light in the horizon. But the horizon is not bright yet, it’s still dark. You can only hope the horizon will get bright and that’s the only way you can weather the storm.”

(C) Lavina Melwani

This article first appeared in Khabar magazine and was also picked up by New America Media.

4 Comments

Thanks – I think there are many more untold stories as the economic landscape continues to change. If anyone would like to share their stories, please do.

Hi Lavina

Indeed a lovely article with insight into all the different businesses and issues

Indu Jaiswal

Excellent article on the effects of the “Great Recession” on the Indian-American community.

Pingback: Tweets that mention Lassi With Lavina » The Buzz » BLURRING OF THE AMERICAN DREAM -- Topsy.com